Startup Fixed Costs

Everyone's business startup costs will start as a few estimates, and over time, land at more focused projections. We need a little bit of time and reality to give us the final answer. Let's dive into the wonderful world of fixed costs to get started on the right foot.

October 18th, 2022 | By: Wil Schroter

The business startup costs that are the least complicated for startups tend to be our "fixed costs" like office space, utility bills, or software expenses incurred. While these start-up costs grow with any new business, they don't scale the way our variable cost projections do when starting a business.

Fixed Costs vs. Variable Costs

The reason we separate our fixed costs versus our variable costs is that we want to isolate our startup cost categories to focus on what will truly drive our business plan. Things like scaling our advertising costs will have an exponential effect on our revenue, for example.

But our fixed costs don't have nearly this impact.

Our fixed expenses do "grow" over time, but not exponentially. Therefore we tend to separate our fixed expenses in a start-up business so that we can forecast them, but not focus on them like variable expenses.

Download and Input your Startup Costs

We've provided a handy income statement to track all of your own business costs from office space to legal fees to insurance costs to market research and beyond.

Download our Startups.com Pro-Forma Income Statement to follow along.

You can use this alongside your accounting software or as a standalone — both work. This will also be necessary if you're going to be looking for startup funding — whether a business loan or equity financing.

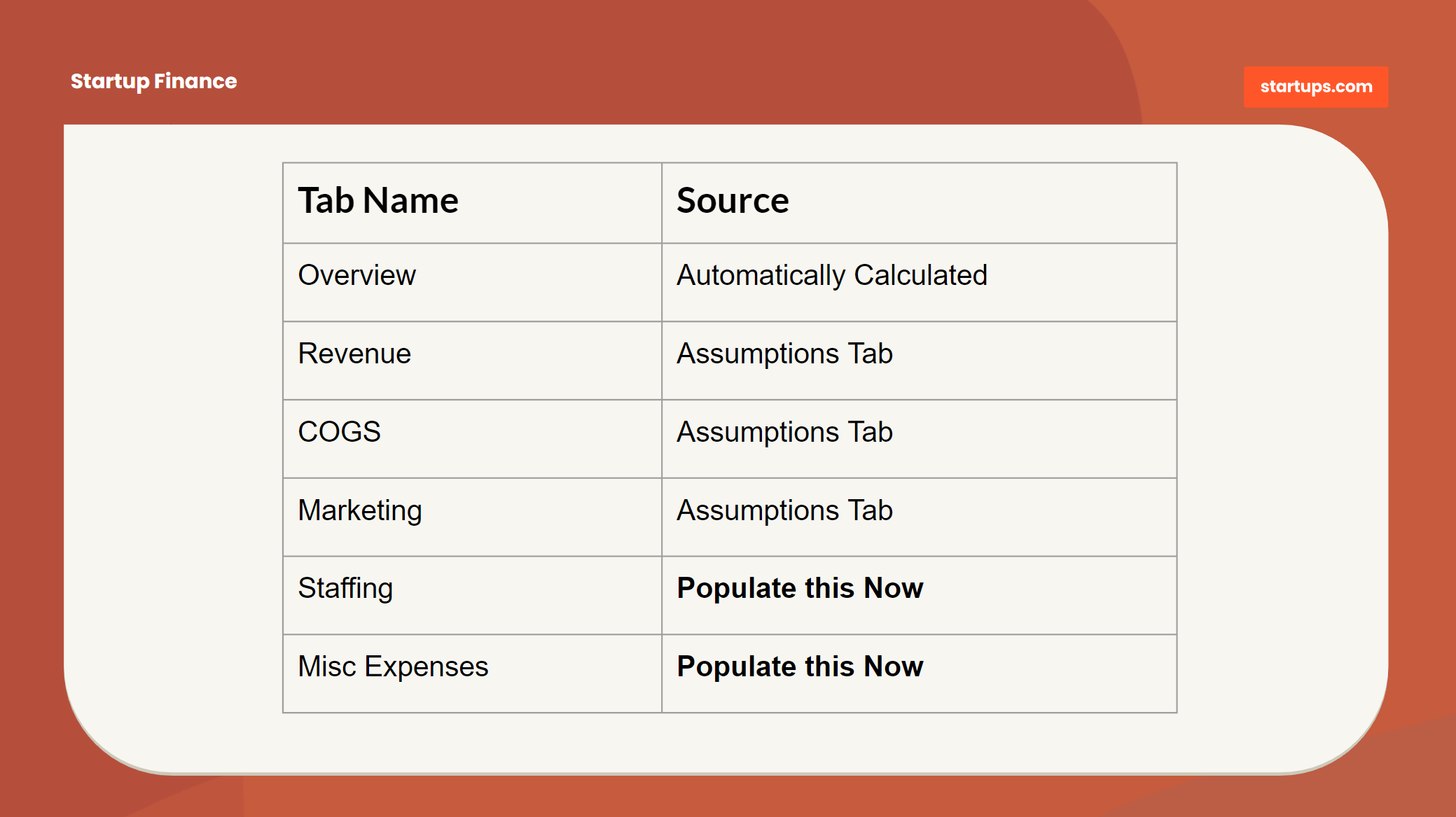

Here are the tabs in the spreadsheet we will work on:

“Staffing” and “Misc Expenses” are considered “Fixed Cost Items” because they shouldn’t change dramatically over the course of the year, and also because they are often not directly correlated to sales volume. There are some nuances we should be aware of, but this should be pretty easy.

Staffing Costs

Let’s start by opening up the “Staffing” tab to get a feel for what types of fixed expenses we want to be tracking. Here we will estimate the pre-launch costs for the year as well as capture and report the actual costs as the year continues.

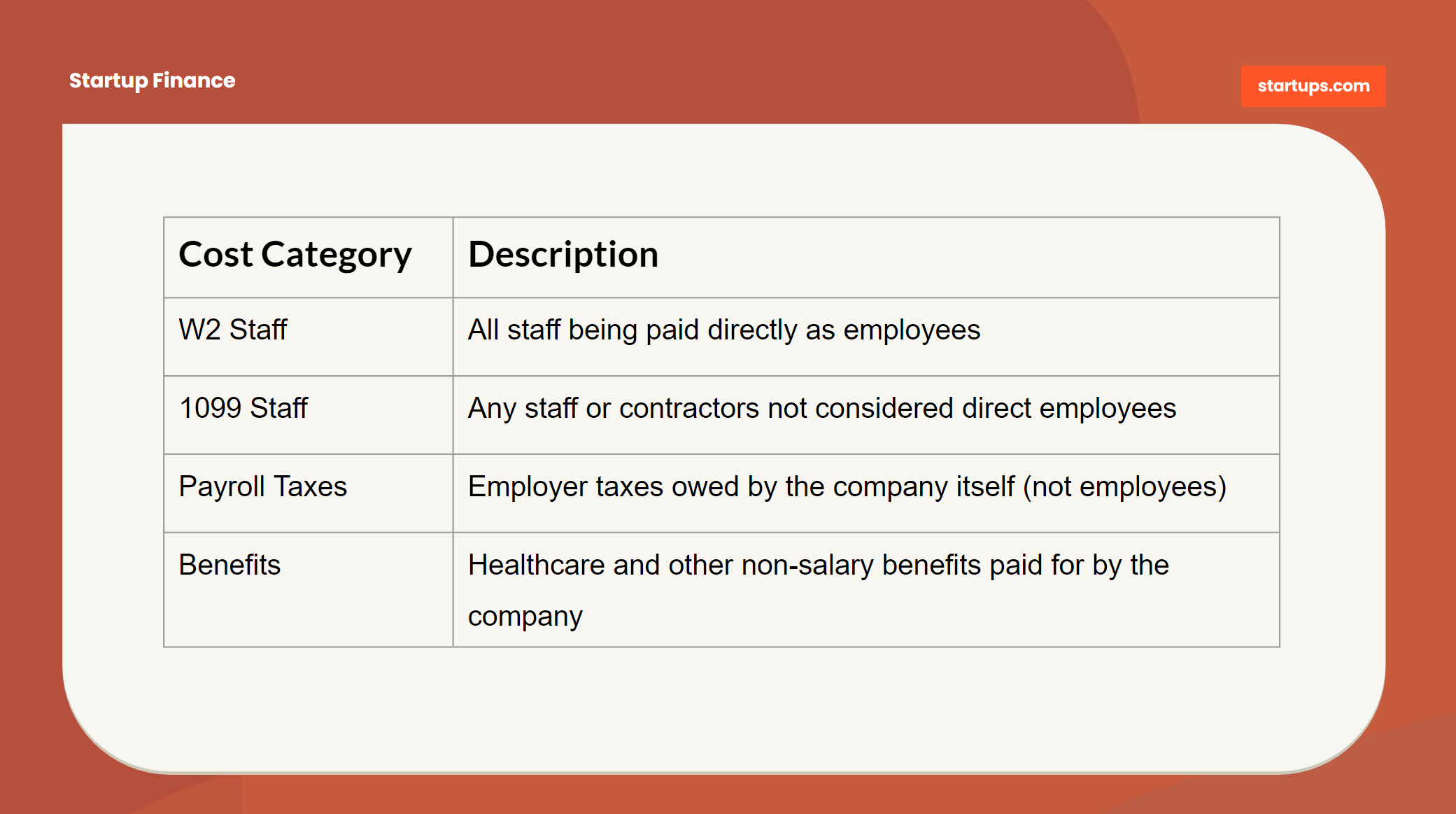

4 Major Cost Categories of Staffing

Initially, we're more focused on forecasting staffing costs from W2 staff to 1099 professional consultants, we just need to know how much capital we'll need for each category.

W2 Staff

Our first category is W2 staff which (in the United States) is a designation for those employees who are rightfully employed by us. These are often referred to as “Salaried” employees but “Part Time” employees would be listed as well.

What’s important about categorizing folks in the early stages is that they are most likely subject to Payroll Taxes (again, in the United States) which need to be forecasted as well.

Forecasting W2 Staff Costs

Forecasting staff will be very different for each type of business, however, there are a few things every team needs to do:

Forecast base staff

To begin let’s add in all of the additional staff using current salaries. Those salaries could be $0 in some cases (yay start-ups!) but we should still capture all of the headcounts that exist in our staff lines.

Forecast future hires

Whether or not we can make future hires, we should add a list of folks that we would like to hire, using a value of $0 each month until we anticipate we may hire them. This is just a forecast, so if we add it to the wrong month, we can adjust it later.

Anticipate merit increases

Most companies budget about 5-10% per year for annual merit increases. Whether or not we decide to increase compensation, we should at least budget for those increases so we have a little risk of protection against future raises!

We will make many adjustments to these numbers, so right now let’s just start with the people we can foresee adding this year and relative timelines (by month) of when they might start.

1099 Staff

Startups often use contractors in many varying capacities, especially in the formative years when there isn’t enough budget to take on full-time help. In the United States, “1099 Staff” means workers who are not direct employees of the company and therefore are considered contractors.

For our purposes, we’ll make a small distinction in where we track contractors between “1099 Staff” (here) and the “Misc Expenses” tab.

A one-time service provider may be booked in the Misc Expenses tab. This is because the working relationship may be unpredictable in terms of frequency and amount of compensation.

Under 1099 staff, we will have contractors who will be serving as 1099s on a predictable and expected basis. We will want to group this on the same tab as W-2s because these relationships will be on a recurring basis akin to core staff.

Payroll Taxes

In the United States, small businesses are required to pay taxes to the government in addition to those that they withhold for their employees. For W2 Staff there is an employer tax expense and an employee tax expense.

For our income statement, we will record the employer taxes that we are responsible for as a business. This could include local employer tax depending on the municipality of operation or the home address of the employee, state employer tax for provisions like unemployment insurance, or Federal employer tax for social programs like Medicare.

Our employer payroll taxes will be captured at the bottom of the staffing tab. It may be difficult to forecast Payroll Taxes if we’ve never done this before or in the event we have no payroll history. We’ve inserted a 12% estimate that calculates the total from W2 Employees and estimates a payroll tax liability.

It is important to note that our payroll processor service will provide us a report after each payroll we run of the applicable employer taxes paid by them on our behalf. This report will provide a centralized and transparent location to aggregate the expenses each month.

Benefits

All employee benefits that we provide should be captured here, ideally on separate line items so that we can forecast and track them closely.

This would include Medical, Dental, Vision, and Life Insurance coverage, 401(k) match contributions, and ancillary benefits like paid gym memberships or other persistent costs that are provided as part of the employment.

Note that meals or other monthly reimbursements will be captured in the “Misc Expenses” tab since they are far more variable and are treated a bit differently. Also, things like professional indemnity insurance related to the business itself would go in the "Misc Expenses" tab as well.

Miscellaneous “Misc” Expenses

Our “Misc Expenses” tab is the catch-all for any other costs that don’t neatly fall within our other prescribed tabs. This could range from anything from our Web hosting bill to the round of lattes the company sprang for.

This is also particularly useful for incidental costs like consultancy fees that we paid one time, incorporation fees to get started, or other expenses that won't likely recur. We're generally trying to separate things we know we'll keep buying like office supplies from things we may or may not pay for again like certain professional services.

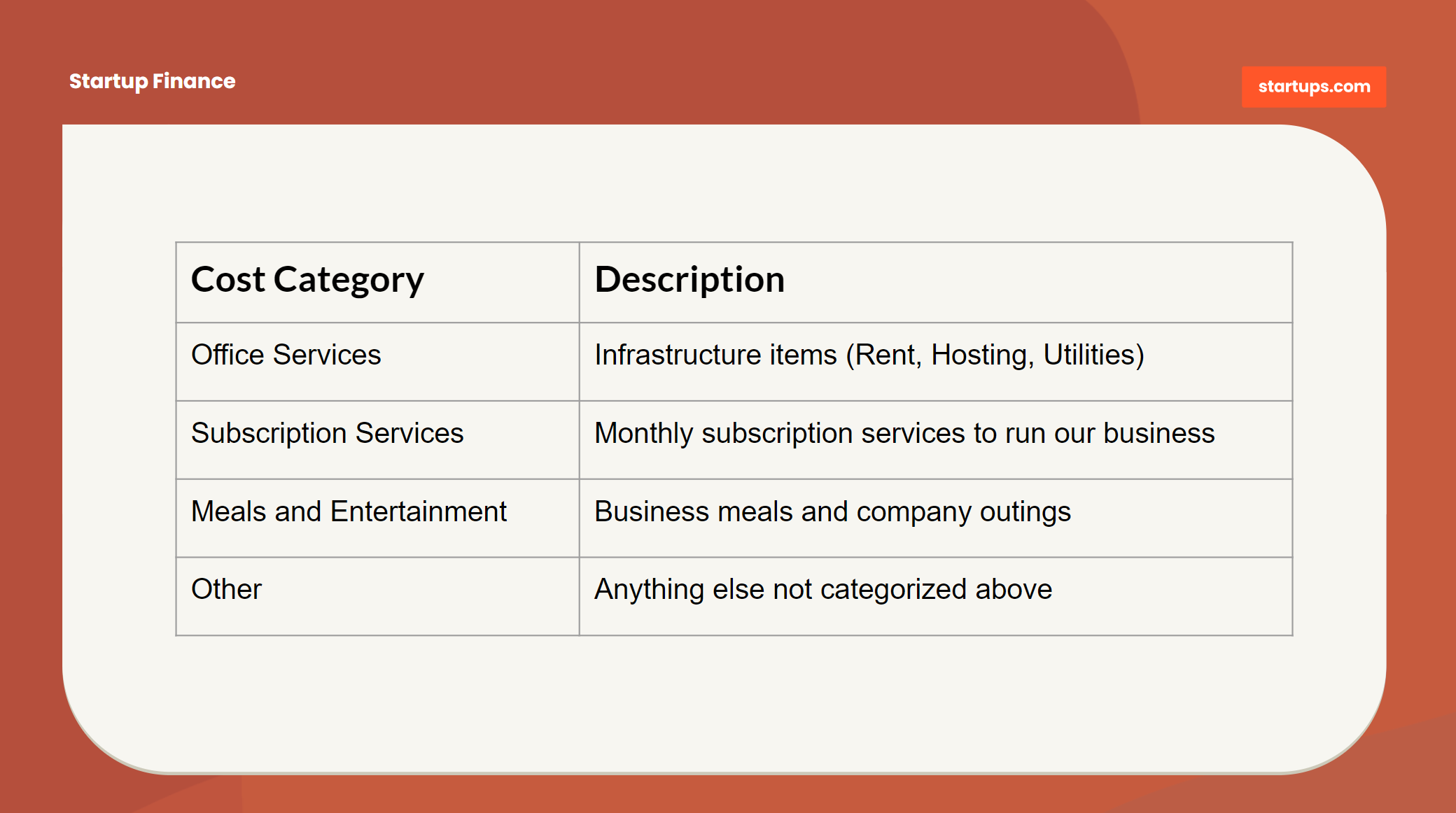

4 Major Categories of Misc Expenses

As always, if we miscategorize one item it’s not a huge issue. We can correct it later. The categories are mostly meant to help us get a quick view of where our expenses are going and where we can expect an increase versus places we might be able to save.

Office Services

Our “Office Services” are loosely referred to as all of the core costs that exist just to keep the lights on. We'll have some tied to our company formation for our legal entity and others that will change over time.

A good analogy here is to think about our personal costs — rent/mortgage, phone bill, internet service bill, electric, gas, and water bill. These are the bare necessities we need in order to operate day to day.

There’s no absolute wrong or right to this category, but it helps to group items that we either absolutely know can’t go away or items that have a high degree of predictability.

How we do it at Startups.com

At Startups.com, we are essentially an “Internet Company” so our Office Services include Web hosting, Internet access, Office Rent, and similar items we know we have to pay no matter what the state of our business.

We don’t need to predict every increase of every line item – we can’t. Instead, let’s just take our existing monthly charges (or those planned) and use the same values throughout the year.

If we’re aware of some deliberate increases, by all means, let’s mark them up in the ensuing months. But don’t worry too much about having to “know exactly what we’ll be paying hosting fees in Month 9” – it’s probably not that critical right now.

Subscription Services

These days most startups run on loads of subscription services, whether it’s MailChimp to send an email, Slack for team chat, or a Startups Unlimited subscription to grow the whole startup faster (what self-respecting Founder doesn’t plug their own services?)

We isolate subscription services for two reasons – they are fairly easy to predict because most costs are consistent and they are the first costs we want to evaluate every month to make sure they are all still active and necessary.

If we’ve ever signed up for any subscription online and had that sinking feeling when we got the first unexpected bill on our credit card statement – we know all about “ghost charges” that come back to haunt us!

Similar to Office Services, we can usually take all of the services we are currently using and copy/paste them across each month using the current charges for the time being.

Meals and Entertainment

We can optionally isolate “Meals and Entertainment” as its own category if we think the volume of either will be meaningful. If we’re only tracking a handful of items each month, we can also consolidate that in the “Other” category.

The only thing worth noting is that under U.S. tax law, “Meals and Entertainment” are usually treated a bit differently as far as an expense (usually only a 50% credit) so it may be handy at the end of the year to have those expenses categorized.

In this case, we won’t likely know exactly how many meals we will eat or where, so a single placeholder amount across every month works just fine.

Other

We hired the world’s most creative minds to help us name this last category. After rejecting such contenders as “Not any of the Above,” “Homeless Wandering Post-Apocalyptic Line Items” and the runner-up “Dude I have no idea, I guess it goes here” we settled on “Other” to name this multi-dimensional category of expenses.

Aside from our cheeky introduction, there’s really nothing exciting about this category. It’s literally a catch-all for any items that don’t have a home elsewhere. If we notice over time that some of our items are recurring on a regular basis, we may move them into “Office Services” or “Subscription Services.” That’s about as crazy as it gets.

For the time being, we’d be best served to use a single placeholder value that we spread across each month. We can then replace that placeholder with actual items and then modify that value as we start to see a recurring trend in monthly spend.

Summary

While we all want to be as "right" as possible about projecting our costs, the reality is we just need a general gauge to get us started. We're still dealing with assumptions, whether it's the cost of our digital marketing or the lease on commercial property.

Everyone's business startup costs will start as a few estimates and over time land at more focused projections. We need a little bit of time and a little bit of reality to give us the final answer.

For now, it's OK to plug in what we think we know, and then fill in the gaps later as we learn.

About the Author

Wil Schroter

Wil Schroter is the Founder + CEO @ Startups.com, a startup platform that includes Bizplan, Clarity, Fundable, Launchrock, and Zirtual. He started his first company at age 19 which grew to over $700 million in billings within 5 years (despite his involvement). After that he launched 8 more companies, the last 3 venture backed, to refine his learning of what not to do. He's a seasoned expert at starting companies and a total amateur at everything else.

Related Articles

Unlock Startups Unlimited

Access 20,000+ Startup Experts, 650+ masterclass videos, 1,000+ in-depth guides, and all the software tools you need to launch and grow quickly.

Already a member? Sign in